Real Estate Investment Trusts, or REITs, are a popular way for people to invest in real estate without owning physical property. In 2024, REITs have evolved to offer better returns and more investment options. They let people earn income from real estate, like malls, apartments, and offices, without the hassle of being a landlord.

One of the most exciting developments in this space is Money 6x REIT Holdings. This innovative investment option stands out because it focuses on maximizing returns through high-yield REITs and smart portfolio diversification. Whether you’re an experienced investor or just starting, Money 6x REIT Holdings offers a modern and efficient way to grow your wealth.

Real estate investment has long been a cornerstone of wealth building, offering tangible assets and steady income streams. With its unique approach Money 6x REIT Holdings is setting a new standard for success in the real estate business. Let’s dive deeper into how it works and why it is becoming so important for investors.

What Are Money 6x REIT Holdings?

Definition and Core Principles of Money 6x REIT Holdings

Money 6x REIT Holdings is a specialized type of REIT designed to provide higher returns by focusing on high-performance properties. These REITs invest only in real estate with high growth potential. This includes commercial properties in booming areas and residential units in high-demand markets.

How They Differ from Traditional REITs

Traditional REITs invest in a wide range of properties, from office buildings to shopping malls. In contrast, Money 6x REIT Holdings focuses on a smaller, selected group of properties. They are expected to deliver higher returns. This targeted approach differentiates it from typical REITs by aiming for growth over stability.

Overview of the “6x” Multiplier Strategy

The “6x” in Money 6x REIT Holdings refers to the strategy of aiming for six times the return of traditional REITs. This multiplier comes from using leveraged real estate investments. This may include some borrowing to boost potential profit. Money 6x REIT Holdings aims to beat standard REITs. It will focus on high-growth properties and use leverage to do so.

The Mechanics: How Money 6x REIT Holdings Work

Detailed Explanation of the Working Model

Money 6x REIT Holdings invests in high-potential properties. These include commercial buildings and homes in growing cities. The goal is to focus on fewer but more profitable investments, unlike traditional REITs that invest in a wider variety of properties. This selective approach helps increase the chances of higher returns for investors.

The Role of Selective High-Yield Property Investments

A key part of the Money 6x REIT Holdings strategy is investing in high-yield properties. These are properties that are expected to generate above-average income or appreciation in value over time. By focusing on such properties, Money 6x REIT Holdings aims to produce higher returns compared to standard REITs.

Financial Leverage and Risk-Adjusted Returns

To boost returns, Money 6x REIT Holdings often uses financial leverage. They borrow money to invest in high-growth properties. This strategy allows them to amplify profits, but it also introduces higher risk. Investors must weigh the risk-adjusted returns. They reflect both the profit potential and the risks. If managed correctly, Money 6x REIT Holdings can offer excellent returns, but if things go wrong, the losses can also be significant.

Comparative Analysis: Money 6x REITs vs. Traditional REITs

Performance Metrics: KPIs like NOI, FFO, and Cash Flow Stability

When comparing Money 6x REITs to traditional REITs, check their performance. Look at metrics like NOI, FFO, and cash flow stability. Money 6x REITs seek higher returns. So, their NOI and FFO may be higher than those of traditional REITs. However, this can be more volatile. The metrics can fluctuate more due to the higher-risk, high-growth properties. Traditional REITs usually provide steady, stable cash flow. This makes them less risky but also less profitable.

High-Growth Potential vs. Stability in Traditional REITs

One of the biggest differences between Money 6x REITs and traditional REITs is their approach to growth. Money 6x REITs focus on high-growth properties, which can lead to higher returns, but with increased risk. Traditional REITs seek a balanced approach. They invest in a wider range of properties for steady income and long-term growth. Traditional REITs are stable and reliable. Money 6x REITs can yield much higher profits, especially in booming sectors or regions.

Liquidity and Flexibility Comparisons

Both Money 6x REITs and traditional REITs offer liquidity and flexibility since they are publicly traded. This means investors can buy or sell shares more easily than if they owned physical property. However, Money 6x REITs can be more volatile due to their focus on higher-risk investments, so there may be more price fluctuations. Traditional REITs are a bit more stable in pricing. This is true if they focus on long-term, stable properties.

Benefits of Investing in Money 6x REIT Holdings

High Return Potential

One of the main reasons investors are drawn to Money 6x REIT Holdings is its high return potential. These investments are designed to generate much higher returns compared to traditional REITs by focusing on high-performance properties in fast-growing areas. So, Money 6x REITs can return six times the investment. This makes them a great choice for those wanting big profits.

Liquidity and Flexibility Advantages

Like traditional REITs, Money 6x REITs offer liquidity and flexibility. This means investors can buy or sell their shares fairly easily, unlike direct property investments that take time to sell. With Money 6x REITs, you can quickly adjust your investment. This makes them a more flexible option in the real estate market. This liquidity allows you to react faster to changes in the market, which is essential for passive income generation.

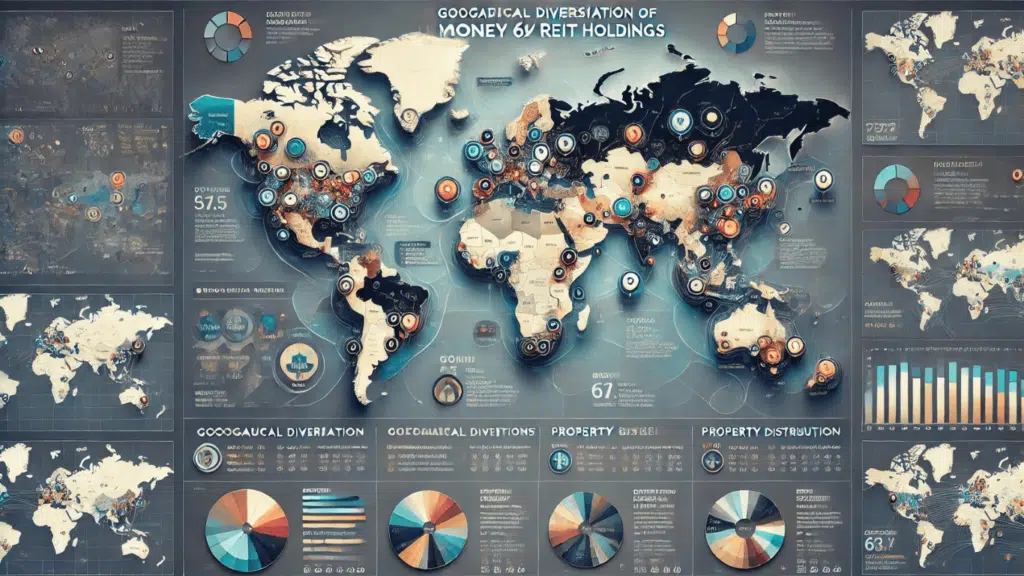

Diversification Opportunities Across Sectors and Geographies

Another key benefit of Money 6x REIT Holdings is the ability to diversify your investments. These REITs often invest in various properties. They include commercial, residential, and specialized types. They are in multiple locations. This real estate diversification reduces risk because if one sector or region underperforms, others may still do well. This strategy spreads risk and can create stable, long-term returns for investors.

Additionally, investing in Money 6x REITs can offer tax-advantaged investments, as these REITs may provide certain tax benefits similar to traditional REITs, further boosting the appeal of this investment option.

Risks Associated with Money 6x REIT Holdings

Market Volatility and Its Impact

While Money 6x REIT Holdings offers high return potential, it also comes with risks. One of the main risks is market volatility. This means the value of these investments can go up and down due to economic fluctuations and changes in the real estate market. A market downturn could reduce the REIT’s property values and your returns.

Risks of Leveraged Investments

Another risk comes from the use of leveraged investments. To achieve higher returns, Money 6x REITs often borrow money to invest in properties. This can increase the potential for higher profits, but it also means more risk. If the market underperforms, leverage could amplify losses. This makes the investment riskier than traditional REITs.

Mitigating Risks Through Informed Decision-Making

To reduce these risks, it’s important to make well-informed decisions. By staying aware of real estate market cycles and understanding the broader economy, you can better assess when to invest in Money 6x REITs. Diversifying your portfolio can help balance risks. Invest in many asset types or sectors to protect your investments.

Strategies for Successful Investment in Money 6x REIT Holdings

Researching the Portfolio and Track Record

Before investing in Money 6x REIT Holdings, it is important to do your research. Look into the REIT’s portfolio of properties and its track record. This helps you understand the types of properties the REIT invests in and how well it has performed in the past. A strong history of solid returns can be a good sign that the REIT will continue to perform well in the future.

Timing Investments with Market Cycles

Another key strategy is to timing investments with market cycles. Real estate markets go through ups and downs, and investing at the right time can increase your chances of getting high returns. For example, investing in a growing market may yield higher returns. But, waiting for a downturn could let you buy at lower prices.

Balancing a Portfolio with Other Asset Classes

It’s also a good idea to balance your portfolio by including different types of investments. While Money 6x REITs can provide high returns, they also come with risks. By investing in other asset classes, such as stocks or bonds, you can reduce risk and ensure that your investments are more stable. A diversified portfolio helps protect against losses in case one type of investment doesn’t perform well.

Long-Term Outlook for Maximizing Returns

Having a long-term outlook is crucial. While Money 6x REITs may offer strong returns, these returns often grow over time. A long-term investment strategy and patience can maximize your profits. Real estate tends to increase in value over time. By thinking ahead, you can make smarter decisions and benefit from the real estate growth potential in the long run.

Market Trends and Future of Money 6x REIT Holdings

Current Market Trends Influencing High-Yield REITs

The real estate market trends are constantly changing. They have a big impact on high-yield REITs like Money 6x REIT Holdings. There is a strong demand for residential properties in many areas, especially as more people look for homes due to population growth. Additionally, the commercial real estate market is recovering as businesses return to offices. These trends are encouraging investors to seek high-performing, high-yield opportunities in these areas.

Emerging Opportunities in Commercial and Residential Sectors

Both the commercial and residential sectors are showing exciting emerging opportunities. In the residential sector, demand for rental properties is on the rise as more people move into urban areas or seek affordable housing. Meanwhile, e-commerce has grown in the commercial sector. This has increased the need for warehouses and distribution centers. As Money 6x REIT Holdings invests in these high-growth sectors, it stands to benefit from these rising trends.

Predictions for the Future of Money 6x REITs

Looking ahead, Money 6x REITs are expected to continue growing as the real estate market trends evolve. With rising demand for homes and businesses, REITs can generate strong returns. There are many opportunities to do so. Also, future investments in high-growth sectors should yield high returns. As Money 6x REIT Holdings adapts to changing market conditions, its potential for growth remains high.

Tax Advantages of Money 6x REIT Holdings

Overview of Tax-Efficient Structures in REITs

One of the key benefits of Money 6x REIT Holdings is its tax-efficient investing structure. REITs are designed to avoid double taxation, which is common for most companies. Instead of paying taxes on their profits, they pass the majority of their income on to investors. This allows the money to be taxed at the individual level. It can then take advantage of lower tax rates. This makes it a smart choice for many investors.

Dividend Income and Tax Benefits

When you invest in Money 6x REIT Holdings, you often receive regular dividend income from the properties the REIT invests in. The good news is that these dividends may be subject to favorable tax treatment. Depending on your taxes, dividend income from REITs may be taxed at a lower rate than regular income. This can increase your investment’s value.

How to Maximize Tax Efficiency in Money 6x REIT Investments

To get the most out of the real estate tax benefits, investors should consider using tax-advantaged accounts like IRAs or 401(k)s to hold their Money 6x REIT investments. This can help you avoid paying taxes on the income until later, when you withdraw the money. Also, timing your investments and managing dividends can lower your taxes. It helps you keep more of your investment earnings. Invest wisely. You can then fully benefit from the tax breaks of Money 6x REIT Holdings.

Expert Insights: Tips for Maximizing Returns

Advice from Industry Experts on Navigating Money 6x REITs

Experts recommend that investors take a careful approach when navigating Money 6x REITs. It’s important to understand the unique features of these REITs, especially how they use leverage to boost returns. Focus on high-performance properties and choose your investments wisely. This will help you make better decisions and boost your chances of success.

Importance of Understanding Market Cycles and Timing

One key tip from experts is to pay close attention to market cycles. Real estate markets can go up and down, and knowing when to invest can make a big difference in your returns. Experts suggest timing your investments to avoid market peaks. This could lower your returns.

Tools and Resources for Better Investment Decisions

To help make informed decisions, it is a good idea to use real estate analysis tools and resources. These tools let you track performance, spot trends, and assess investments. Experts suggest using professional advice and staying updated on real estate news. This helps you see how factors like interest rates can affect your ROI. Using these tools with expert investment advice can boost your returns.

Regulatory Considerations and Compliance

Overview of Regulations Affecting Money 6x REITs

When investing in Money 6x REITs, it is important to understand the regulations that apply to these investments. Like other financial products, REIT rules ensure companies follow specific rules. They must be transparent, pay taxes, and manage their assets well. These rules help protect investors by making sure the REITs operate in a legal and ethical manner.

The Role of Financial Advisors in Ensuring Compliance

Financial advisors play a key role in helping investors stay compliant with these regulations. They can help you with the complex rules of financial compliance. They will ensure your investments meet legal standards. Advisors help you navigate the paperwork and ensure that you are following all the necessary legal steps to stay on track.

Adapting to Regulatory Changes for Stable Returns

Regulations can change over time, and it’s important for both investors and REIT companies to adapt. Stay informed about real estate laws and changes. This will keep your Money 6x REIT investments successful and compliant. Adjusting your strategy to meet new rules can help. It can maintain stable returns and protect your investment.

Final Thoughts:

Money 6x REIT Holdings offers a unique and exciting opportunity in modern real estate investing. With the potential for high yields and innovative investing strategies, these REITs allow investors to take advantage of real estate growth in a more flexible and strategic way. But it is important to remember that with high returns come calculated risks. By understanding the risks and rewards, you can make smarter investment choices.

As you explore ways to enhance your investment portfolio, consider adding Money 6x REITs to diversify your assets. These REITs can be a key tool for building a future-proof portfolio and reaching your financial goals. Investing wisely in these modern real estate opportunities could help you achieve real estate success.